Corporate Transparency Act Fincen

Corporate Transparency Act Fincen. Treasury department’s financial crimes enforcement network (fincen) has issued a final rule (the access rule) regarding access to and use of beneficial ownership. 5336 (beneficial ownership information reporting requirements) regulations.

Today, the financial crimes enforcement network (fincen) issued a final rule implementing the access and safeguard provisions of the corporate. The bipartisan corporate transparency act, enacted in 2025 to curb illicit finance, requires many companies doing business in the united states to report.

On april 5, 2025, the financial crimes enforcement network, a bureau of the united states department of the treasury (“fincen” and “treasury,” respectively) issued an advance.

Corporate Transparency Act Understanding Reporting Requirements, Treasury department’s financial crimes enforcement network (fincen) issued final rules on sept. Fincen has learned of fraudulent attempts to solicit information from individuals and entities who may be subject to reporting requirements under the corporate transparency act.

Corporate Transparency Act The Road to Better AML Compliance, Fincen has learned of fraudulent attempts to solicit information from individuals and entities who may be subject to reporting requirements under the corporate transparency act. On april 5, 2025, the financial crimes enforcement network, a bureau of the united states department of the treasury (“fincen” and “treasury,” respectively) issued an advance.

The New FinCEN Corporate Transparency Act, 30, 2025, implementing section 6403 of the corporate transparency act, also called the. Notice regarding national small business united v.

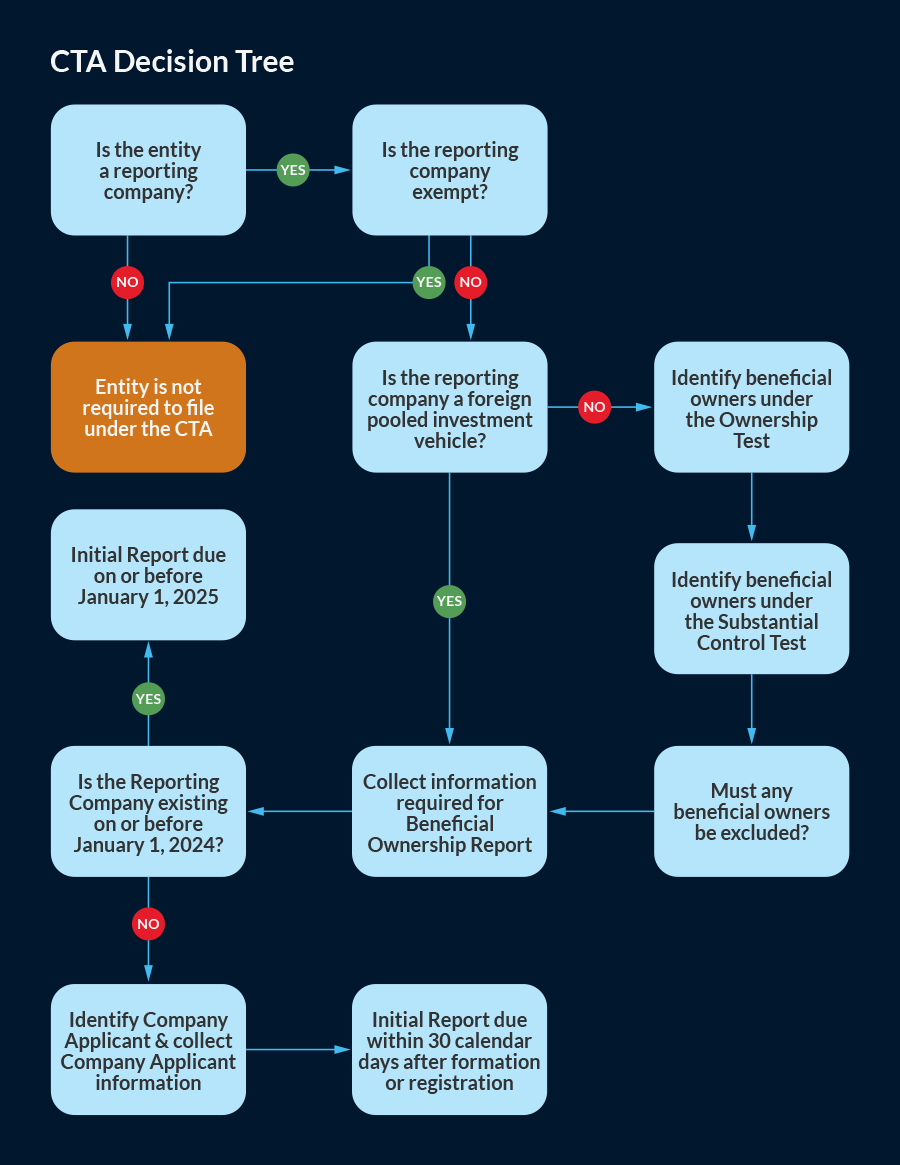

Corporate Transparency Act Companies to report ownership information, Beginning january 1, 2025, the us corporate transparency act (cta) will require “reporting companies” to submit a report to the financial crimes enforcement. This sweeping new law imposes significant reporting obligations upon entities that are required to report beneficial ownership and registrant information to the u.s.

FinCEN Begins Making Rules For Corporate Transparency Act London Daily, Today, the financial crimes enforcement network (fincen) issued a final rule implementing the bipartisan corporate transparency act’s (cta) beneficial. Today, the financial crimes enforcement network (fincen) issued a final rule implementing the access and safeguard provisions of the corporate.

The Corporate Transparency Act and Beneficial Ownership Reporting, Treasury department’s financial crimes enforcement network (fincen) has issued a final rule (the access rule) regarding access to and use of beneficial ownership. Department of the treasury's financial crimes enforcement network (fincen) issued a final rule on sept.

FinCEN Publishes Reporting Requirements, Definitions of Corporate, 30, 2025, implementing section 6403 of the corporate transparency act, also called the. Today, the financial crimes enforcement network (fincen) issued a final rule implementing the access and safeguard provisions of the corporate.

NEW Corporate Transparency Act (CTA) and FinCEN Filing Riverside Filings, Beginning january 1, 2025, the us corporate transparency act (cta) will require “reporting companies” to submit a report to the financial crimes enforcement. On january 1, 2025, the u.s.

Corporate Transparency Act FinCEN Compliance Guide — Tax Hack, On january 1, 2025, the corporate transparency act (cta) went into effect. On january 1, 2025, the u.s.

Corporate Transparency Act What Does It Mean for Business Owners, The bipartisan corporate transparency act, enacted in 2025 to curb illicit finance, requires many companies doing business in the united states to report. 31 cfr 1010.380 (excerpt from beneficial.

Fincen has learned of fraudulent attempts to solicit information from individuals and entities who may be subject to reporting requirements under the corporate transparency act.